Understanding the Steady Rise of Bitcoin: Key Drivers Behind BTC's Growth

In recent years, Bitcoin has been getting more and more attention from professional investors. Here are some key statistics and trends:

Learn about Bitcoin from zero to one.

How to get Bitcoins?

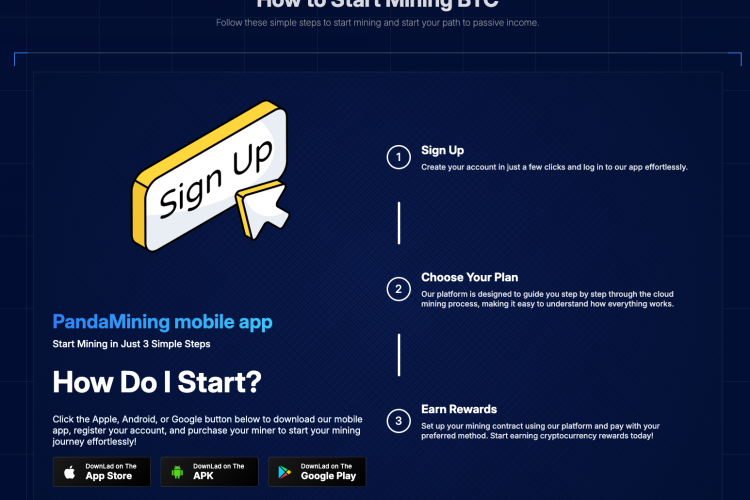

Mining is the only way Bitcoins are produced! In addition to mining you can also buy Bitcoins directly from the market.&

Why does bitcoin mining cost less than buying bitcoins outright?

The process of paying your monthly electricity bill can be understood as DCA bitcoin, contact us today to get a detailed calculation.

Bitcoin & Ethereum: Shaping the Future of Crypto

Introduction

Welcome to Elven’s Block Talk, your go-to podcast for deep dives into the world of cryptocurrency and blockchain. I’m your host, Elven, here to break down the latest trends, stories, and market developments shaping the crypto industry .

Today, we’ll explore two major narratives: Bitcoin’s ambitious push towards $100,000 and the explosive growth of Bitcoin and Ethereum ETFs in the U.S. under the Trump administration. As we connect the dots between price action, policy changes, and institutional investments, stick around for insights into what this all means for the future of digital assets. If you enjoy staying ahead in the world of crypto, don’t forget to subscribe, share, and leave us a review. Let’s dive in!

[Segment 1: Bitcoin’s Road to $100,000]

BTC Chart

View Bitcoin Price Chart

Bitcoin recently flirted with the $100,000 milestone, reaching $95,734 before pulling back. While optimism initially surged, a mix of market dynamics held it back from breaking that psychological barrier.Several factors are at play:

- Diversified Capital Flow: While institutions like MicroStrategy continue buying Bitcoin aggressively, funds are increasingly flowing into other assets like Ethereum and XRP. This diversification reflects the broader maturation of the digital asset market.

- Profit-Taking Behavior: On-chain data shows that many short-term holders cashed out when Bitcoin’s price exceeded $90,000, creating downward pressure.

- Government-Owned Bitcoin Transfers: News that the U.S. government moved $2 billion in Bitcoin from Silk Road seizures to Coinbase added to the market’s nervousness, sparking fears of a potential sell-off.

- Futures and Options Signals: Data from Coinglass reveals cautious activity in the derivatives markets, with increased demand for downside protection indicating uncertainty about Bitcoin’s short-term trajectory.

Despite these challenges, the long-term institutional interest in Bitcoin remains robust, which could eventually propel it beyond the $100,000 mark.

Bitcoin’s journey isn’t over yet. Milestones like this require time, patience, and steady market support.

Bitcoin & Ethereum: Pioneers of the Digital Currency Revolution

[Segment 2: Ethereum and Bitcoin ETFs – A Game-Changer?]

Switching gears, the U.S. crypto market has seen a historic surge in ETF inflows. In November alone, Bitcoin ETFs attracted $6.5 billion, while Ethereum ETFs pulled in $1.1 billion.

Why the buzz? Here’s what’s driving it:

- Trump’s Crypto-Friendly Stance: Trump’s pledge to ease regulations and establish a strategic Bitcoin reserve has reignited market enthusiasm. This pivot from the Biden administration’s stricter approach is injecting fresh confidence into the industry.

- Ethereum Outperforming Bitcoin: Since Trump’s election win, Ethereum has outpaced Bitcoin in growth, supported by ETFs like BlackRock’s iShares Ethereum Trust. As the foundation of smart contracts and decentralized applications, Ethereum’s real-world utility is a magnet for institutional investors.

- Rising Demand for Asset Diversification: As Bitcoin’s price stabilizes, assets like Ethereum and XRP are gaining traction. XRP, in particular, has rallied on expectations of regulatory relief under the Trump administration, fueling speculation of a future XRP ETF.

This growing interest in diversified assets signals a maturing market, with ETFs driving a positive feedback loop of confidence and investment.

The rise of crypto ETFs marks a turning point. They’re not just investment vehicles—they’re endorsements of crypto’s place in mainstream finance.

So, where does this leave us? The interplay between Bitcoin’s price dynamics and the booming ETF market underlines the crypto industry’s evolving landscape. For investors, the keys to success lie in staying informed, diversified, and adaptable.

Remember, the road ahead for crypto isn’t just about price milestones—it’s about the policies, technologies, and innovations that shape its foundation.

Thank you for tuning in to Elven’s Block Talk! If you enjoyed this episode, please subscribe and share it with your friends. Together, we can build a community of crypto enthusiasts who stay ahead of the curve. Until next time, stay curious and keep exploring the world of digital assets!

Conclusion

In this episode of Elven’s Block Talk, we examine Bitcoin’s push towards $100,000 and the record-breaking inflows into Bitcoin and Ethereum ETFs in the U.S. Explore the forces shaping these trends, from institutional diversification and profit-taking behaviors to Trump’s crypto-friendly policies. Learn how these dynamics are redefining the market and what they mean for the future of digital assets. Tune in, subscribe, and stay ahead in the fast-evolving world of crypto!

If you’re ready to take the next step in Bitcoin investment or have any questions, we’re here to help. Contact us now, and our team will assist you!

Who we are

At BitPloutos, we are committed to delivering in-depth, precise investment analysis and forward-looking market insights. With extensive experience in the financial sector and a unique approach to analysis, we empower our clients to navigate the complexities of financial markets with confidence. Our team consists of seasoned investment experts who not only understand market trends but also possess a profound knowledge of cryptocurrency assets, particularly Bitcoin, and the opportunities and risks associated with them.

We recognize the critical nature of market timing. That's why, at BitPloutos, we offer real-time data analysis and forecasting, paired with continuous market monitoring to help uncover hidden opportunities. Whether for long-term investments or short-term strategies, we provide professional guidance and market sensitivity to support our clients in achieving substantial returns in the digital asset space.

Unlock the potential of Bitcoin mining with guidance from industry-leading experts. Our advisors deliver in-depth knowledge and innovative strategies, ensuring you maximize returns while minimizing risks. Whether you're just starting or looking to scale, we provide tailored insights and hands-on support for every stage of your mining journey. Connect with us today to leverage our global expertise and drive your success in Bitcoin mining.